India’s central bank should have paid more attention to Surf if it wanted to get ahead of the inflation challenge.

The price of the detergent increased by 20% in January. While that’s hardly news, as most everyday things are getting more expensive everywhere, the interesting part was the retail price before the change: 10 rupees (13 US cents) for a bar.

Such small bars of detergent are intended for less affluent consumers who often can’t spend more rupees without cutting corners on something else. To prevent these customers from downgrading to cheaper products, Unilever Plc’s India franchise relies on “magic price points” – such as 5 or 10 rupees – that help buyers stay within their tight budgets.

“Nearly 30% of our revenue comes from packages that work at magical prices,” Ritesh Tiwari, the finance director of the Indian unit, said during the December quarterly earnings call. For these packages, the weight saving is the company’s preferred method of exerting pricing power. “As a result, even the same number of units sold leads to a drop in volume,” he said.

That is why most of the 11% growth in Unilever’s sales in India in the last three months of 2021 came from price increases. Underlying volumes – raw materials leave the factory – rose only 2%. Rivals fared worse. India’s broader consumer industry saw volumes decline, with rural areas posting a 4.8% decline, compared to a 0.8% decline in cities, NielsenIQ said.

As India’s largest consumer company, Unilever has struggled between quantity and price. But then, the pressure on raw material costs became too great to maintain the illusion of affordability. Hence the bump in January when a Self Excel bar from 10 rupees was marked down to 12 rupees, and the cheaper Wheel brand washing powder saw its price rise by 1 rupee to 31 rupees for half a kilo.

This capitulation of some small packages to non-magic prices — plus the 41 mentions of “inflation” on that quarterly earnings call — should have given the Reserve Bank of India a warning: the dam broke; in fact, the costs weighed too heavily on the profitability of large companies to observe the finer points of consumer psychology.

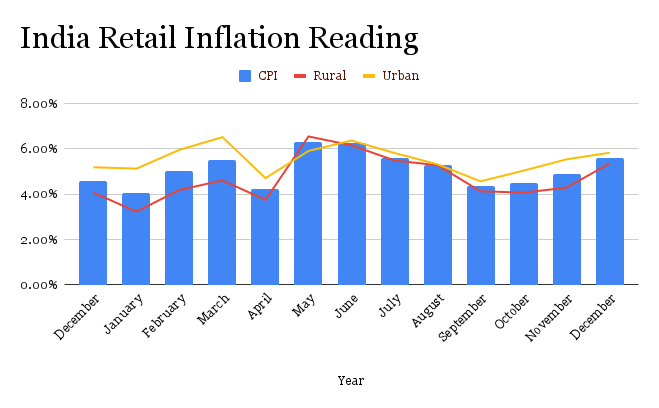

But to delay what even then seemed an inevitable hike in interest rates, the RBI went ahead and projected inflation at a favorable 4.5% for the fiscal year ending in March next year. That was in February. The first rate hike – a move of 40 basis points – came on May 4. By then, India’s inflation problem was already entrenched and getting worse. Last month, the 500ml Vim dishwashing liquid went from 1 rupee less than the magic price of 100 rupees to 4 rupees more.

Pranjul Bhandari, the Indian economist at HSBC Holdings Plc in Mumbai, estimates that only about half of the increase in input costs over the past six months has been passed on to output prices. She says that costses are being passed on faster in rural areas where unregulated prices of kerosene and bulk diesel have risen faster than regulated prices of electricity in citiys. “As electricity rates increase over the next 12 months, urban production and living costs could hurt growth.”

Not just electricity. Demand for services is still trying to catch up to pre-pandemic levels. As the ongoing recovery in contact-based industries such as travel progresses, they will pass on some of their cost pressures, following the strategy of consumer goods companies. Add expensive foods to this list, and it’s unclear whether inflation will return from 7.8% in April to 4% in the near term – the midpoint of the central bank’s tolerance range. That clouds the outlook for how high Indian interest rates should go and how much output growth should be sacrificed.

What Unilever calls its magic price points,

., a homegrown hair oil and honey maker described as “scared,” Bloomberg News reported Friday. When companies save weight to defend prices, they also hope consumers will return more often. That doesn’t always happen.

Working at magic prizes is like performing a high school experiment in “titration”, where one liquid with known properties is dripped into another with an unknown concentration and stops when the color changes. Unlike all other substances in the lab, the consumer is an active participant in this experiment. In a country where families earning less than the median household income of about $2,300 represent only 10%-15% of total consumption, a large number of people “would be very aware of money spending and would titrate the volume to protect their wallet because their wallet is so small and so limited”,

Chairman Sanjiv Mehta said about the profit call.

Inflation in the US is also stubbornly high at 8.3%, but unemployment is at least low 3-hourly wages are rising. In India, employment rose by 7 million only in April after a cumulative decline of 10 million in the previous three months, according to the Center for Monitoring Indian Economy. Of the 900 million eligible to work, only two-fifths have a job or are looking for work.

Perhaps the central bank wanted a stronger labor market recovery before raising interest rates. But at least in January – a month before the start of the war in Ukraine – it should have read the troubling signs of magic prices. Now it will have to work harder to fight inflation and make up for the loss of credibility.